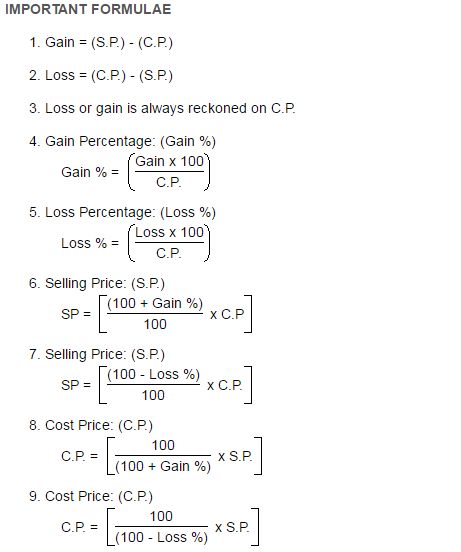

Formula of profit

The concept is used to judge the ability of an entity to set reasonable price points manufacture goods cost-effectively and operate in a lean manner. As a performance measure ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several.

Profit And Loss Rs Aggarwal Class 7 Maths Solutions Exercise 11a Maths Solutions Math Formula Chart Math Problem Solving Strategies

The profit formula is stated as a percentage where all expenses are first subtracted from.

. Return on investment ROI or return on costs ROC is a ratio between net income over a period and investment costs resulting from an investment of some resources at a point in time. If the coffee costs 080 per cup to make and you sell 400 cups daily whats your daily gross profit. X profit price.

Profit formula is used to know how much profit has been made by selling a particular product. Profit is always based on the Cost price. In certain cases profit or loss is calculated as a percentage of the cost price.

Given the Selling PriceSP and percentage profit or loss of a product. Sales Profit Expenses. The formula of gross profit margin or percentage is given below.

In the table shown we have price and cost but profit is not broken out separately in another column so we need to calculate profit by subtracting Cost from Price. Under this method the target profit is added in the total fixed expenses and the resultant figure is then divided by the unit contribution margin. The general formula where x is profit margin is.

From the start youre accounting for your profit taxes and pay. Revenue 3 x 400. ABC is currently achieving a 65 percent gross profit in her furniture business.

Contribution margin method for target profit. SP 900 Loss Percentage 10 Output. Profit Margin 10 Profit Margin Formula Example 2.

Fixed costs are not included in the gross profit formula but only the variable costs. Formula for profit is majorly used for business and financial transactions. Ie 20 means the firm has generated a.

After covering the cost of goods sold the remaining money is used to service other operating expenses like sellingcommission expenses general and administrative expenses Administrative Expenses Administrative expenses are indirect costs incurred by a business that are not directly related. Profit arises when the selling price of any product sold is greater than the cost price that is the price at which the product was originally bought. Is it the condition of profit or loss.

Profit Total Sales Total Expense. Again the formula for profit per unit can be derived by deducting the cost price of production from the selling price of each unit as shown below. Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65.

To calculate the percentage of profit earned from a particular sale the formula that is used is. The profit formula plays a major role in any income statement Income Statement The income statement is one of the companys financial reports that summarizes all of the companys revenues and expenses over time in order to determine the companys profit or loss and measure its business activity over time based on user requirements. Why Net Profit Margin Is Important.

Gross profit percentage formula Total sales Cost of goods sold Total sales 100. Usually companies use this metric to help establish budgets forecast development potential and optimize investments. SP 1020 Profit Percentage 20 Output.

Find the profit or loss using the profit formula then convert it to a profit or loss percentage by expressing it as a fraction with the cost price as the denominator. Then by using the operating Margin formula we. Cost Volume Profit Analysis includes the analysis of sales price fixed costs variable costs the number of goods sold and how it affects the profit of the business.

After this step the profit percentage can be calculated using the formula ProfitCost Price 100. Note- It is to be strictly noted that the Profit or Loss percentage is always calculated on the Cost Price of an item until and unless it is mentioned to calculate the percentage on Selling Price. 75000 and he sold it for Rs55000.

The Profit First formula. In business and accounting net income also total comprehensive income net earnings net profit bottom line sales profit or credit sales is an entitys income minus cost of goods sold expenses depreciation and amortization interest and taxes for an accounting period. The aim of a company is to earn a profit and profit depends upon a large number of factors most notable among them is the cost of manufacturing and the volume of sales.

Whats leftover is the budget your company has to spend on things like rent. There are two main reasons why net profit margin is useful. Profit Percentage Formula ProfitCP 100.

Using the above formula Company XYZs net profit margin would be 30000 100000 30. It is computed as the residual of all revenues and gains less all expenses and losses for the period. Since target profit is an estimation its important to remember that the actual.

What is the Profit Percentage Formula. The profit formula is the calculation used to determine the percentage profit generated by a business. Net Profit Margin Formula.

It measures the ability of the firm to convert sales into profits. A high ROI means the investments gains compare favourably to its cost. The task is to Calculate the cost priceCP of the product.

Net profit margin is an easy number to examine when reviewing the profit of a company over a certain period. As an example of gross profit calculations pretend youre a coffee shop owner who sells a cup of espresso for 3. Profit and Loss Percentage Example.

Shows Growth Trends. Gautam has started a new business in the gym around a year ago. The COGS formula is the same across most industries but what is included in each of the elements can vary for each.

What is Gross Profit Formula. Operating profit is the profit generated from the core business after deducting all the related operating expenses depreciation and amortization from its revenue but before deducting interest and taxes. The basic components of the formula of gross profit ratio GP ratio are gross profit and net sales.

CP 850 Input. Gross Profit Formula Example. Profit percentage is a top-level and the most common tool to measure the profitability of a business.

Cost of Goods Sold 080 x 400. The Profit First formula puts profit first and encourages you to deduct profit from each sale and use the remaining amount for expenses. Raj purchased a bike for Rs.

Relevance and Use of Profit Percentage Formula. The gross profit margin formula is then. Gross Profits Net Sales x 100 Operating Profit Margin This margin includes both costs of goods sold costs associated with selling and administration and overhead.

Net sales are equal to total gross sales less returns inwards and discount allowed. The target profit formula is a calculation used by businesses to estimate how much revenue the company should produce over a set period of time. The gross profit formula is used to determine a companys gross profit for a financial year.

In order to calculate profit and loss the concepts of fraction and percentage are used. The gross profit formula needs the revenue earned for that year by a company and the cost of the goods sold for that year in the company. Finally the formula for profit can be derived by subtracting the total expenses step 2 from the total revenue step 1 as shown below.

Gross profit is equal to net sales minus cost of goods sold. He was inexperienced in the business and he feels he has made adequate sales to recover from loss and appears to be making a profit. Notice that to get target profit formulas or equations we have just included the target profit to break-even point formulas.

X price-cost price x 5-4 5 x 1 5 x 020.

Profit And Loss Basics And Methods Examples Math Tricks Math Tricks Math Profit

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infograph Financial Literacy Lessons Economics Lessons Finance Education

Mathematics Formulas Chart Math Formula Chart Formula Chart Math Formula Chart Math Formulas

Profit And Loss Rs Aggarwal Class 7 Maths Solutions Exercise 11a Maths Solutions Math Formula Chart Math Problem Solving Strategies

Profit And Loss Profit And Loss Formula Youtube Education Math Loss Profit

Profit Loss Profit And Loss Important Formulas Youtube Math Methods Maths Ncert Solutions Profit And Loss Statement

Profit And Loss Formulas By Bhumika Agrawal Studying Math Basic Math Skills Maths Formula Book

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

How To Find Profit And Loss Calculate Profit And Loss Using Formula Youtube Profit And Loss Statement Profit Math Videos

How Do You Find Percentage Profit Or Loss Maths Formula Book Math Formulas Find Percentage

Profit And Loss Rs Aggarwal Class 8 Maths Solutions Ex 10a Http Www Aplustopper Com Profit Loss Rs Aggarwal Cla Maths Solutions Math Methods Math Formulas

Profit And Loss Rs Aggarwal Class 8 Maths Solutions Ex 10a Http Www Aplustopper Com Profit Maths Solutions Math Formula Chart Math Problem Solving Strategies

Profit And Loss Rs Aggarwal Class 8 Maths Solutions Ex 10a Http Www Aplustopper Com Profit Loss Rs Aggarwal Cla Maths Solutions Math Methods Math Formulas

Profit And Loss Important Formulas Aptitude Loss Aptitude And Reasoning

Profit And Loss Formula Profit And Loss Questions Profit And Loss Notes Pdf Profit And Loss Notes For Ssc Cgl Profit And Los Math Notes Math Math Questions

Pricing Formula Startup Business Plan Small Business Plan Bookkeeping Business